Should You Pay Off Your Mortgage Early?

Many people love the idea of home ownership and hate being in debt. Naturally, this leads to the thought of paying off the mortgage early to be free of debt as soon as possible. But for many people, this is the wrong move financially. I’ve seen many videos on Instagram and TikTok that pick one side of this issue without fully explaining the context. So today, I’m going to explain why people would want to pay off a mortgage early, and how the alternative use of that cash is usually a better choice.

Why Do People Want to Pay Off Mortgages Early?

There are many reasons why someone would want to be free of a mortgage:

There’s a satisfaction to owning a property free and clear

No longer having to worry about making large monthly payments

It will increase your credit score

Each of these can be a great reason to want to pay off a mortgage early, but it’s important to weigh the benefits against the opportunity cost of using the money elsewhere. In this case, I’m going to assume that you would invest the extra payment money into a broad index fund.

Why Would Investing Be Better?

The choice between using extra money to pay down debt and investing it really comes down to one comparison: the interest rate of the debt compared to the expected rate of return on investments. Paying down additional amounts on a mortgage will get you a return on your investment equal to the rate of the debt, and investing the same amount will get you a return based on the investment. Therefore, if the investment returns are expected to exceed the rate of interest on the mortgage, it's better to invest. In the last year, mortgage rates hovered around 3% for the most qualified borrowers, while the average return of the S&P 500 over the last 30 years has been around 8% when adjusted for inflation. So as long as mortgage rates remain lower than the expected return on investments, it will be a better use of funds to invest instead of putting additional money towards mortgage principal.

Let’s Run Some Numbers

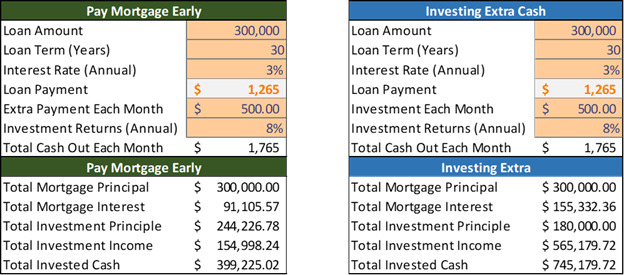

To drive this example home, let’s compare two strategies, each with a 30-year mortgage for $300,000 at a fixed interest rate of 3% and an extra $500 to either invest or pay towards the mortgage principal. One strategy will use the extra $500 to invest for the full 30 years, while the other will pay down the mortgage, and then invest full monthly amounts after the mortgage is paid until the end of the 30th year.

Here are the results:

By investing the extra $500 every month into the market, you could have an extra $346k lying around at the end of 30 years due to the power of compounding interest. The benefit of investing versus paying down the mortgage will be different depending on actual returns and mortgage rates, but this example demonstrates that putting your extra money towards the higher yielding option will leave you much better off in the long run.

What Should I Do?

If you have extra cash that you want to put towards your mortgage, and you don’t see a point in the future where you wouldn’t be able to make the base payments on the mortgage, you should invest the money instead. Mortgages are the lowest interest debt that many people will hold in their lives, and paying it off early would be letting a number of benefits go to waste. That being said, it’s important to understand that certain personal situations where immediate cash flow adjustments are needed may make paying off a mortgage early a better option.